Here is a Tool Kit of reports, a process flow chart and an easy to use template to help you get paid.

Are you sick of chasing people for money?

It sucks doesn't it. You've worked your a** off listening to what they wanted and you know you completed the job the way it should be done but they are now refusing to pay you.

It sucks doesn't it. You've worked your a** off listening to what they wanted and you know you completed the job the way it should be done but they are now refusing to pay you.

Debt Recovery Tool Kit. (because chasing people for money SUCKS!!)

But first . . .

What causes a payment dispute with a customer?

Now, you haven't been paid anything other than your deposit and 1 progress payment; you've outlaid for materials and labour; The client is threatening to sue you for $140,000.

Now, you haven't been paid anything other than your deposit and 1 progress payment; you've outlaid for materials and labour; The client is threatening to sue you for $140,000.You and your client relationship.

Debt Recovery begins with you and how you set up every one of your clients

in the first place.

Then a few months down the track they appear to have forgotten your last invoice. You call and talk to the accounts payable clerk who tells you "weren't you told . . . unless your invoices are in by the 25th of each month, you don't get paid till the next month!"

Then a few months down the track they appear to have forgotten your last invoice. You call and talk to the accounts payable clerk who tells you "weren't you told . . . unless your invoices are in by the 25th of each month, you don't get paid till the next month!"Are you unsure what your options are when getting somebody to pay?

Debt Recovery Tool Kit - FREE Resources:

Have you ever not been paid? Why your 'Terms and Conditions' on your invoice REALLY matter.

Having trouble getting paid? This tool looks at ways you can streamline your invoicing and a cool trick to 'cover your A**' when big firms just call you with work and there is no written agreements between you.

Payment disputes with clients. Have you ever had a client with unrealistic expectations? Here's the tool to stop that happening ever again.

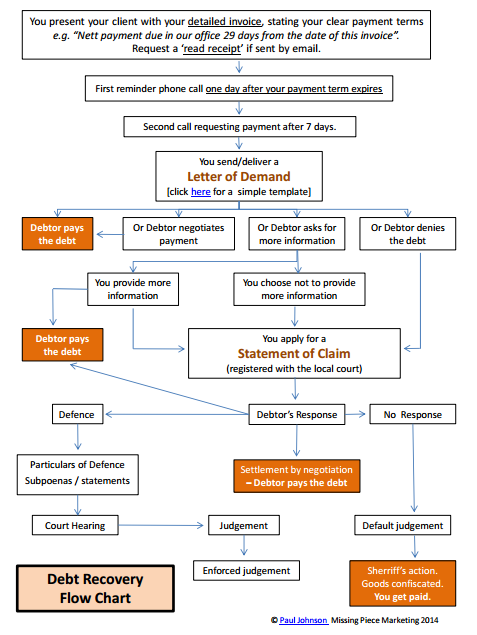

Download this PDF (Debt Recovery Flow Chart) so you know what to do and where to go to get paid (before you have to go to court - and what happens after you do)

[NB This is a graphical overview applicable in many countries in the world (but check your local jurisdiction].

FREE template of a Letter of Demand here. Now you don't have to get it wrong when you decide to get a bit tougher about collecting what's making it hard to feed your family!

Debt Recovery - Definition of a 'Small Claim'.

Countries and State jurisdictions set the upper limit for a matter to be dealt with simply (with less cost), in a 'Small Claims Court (or Tribunal)':

e.g. New South Wales is $10,000 and California it is $5,000; New Zealand it's $15,000

Queensland it is $25,000

Scotland it's usually £3,000; United Kingdom has an online system for claims up to £100,000

Massachusetts it is $7,000; Utah $10,000 ; Colorado $7,500 ; Missouri $5,000 ; Pennsylvania $8,000 or here is a link to a table you can use as a guide in your US state (but check with a lawyer within your local jurisdiction)

Canada it's $25,000 Canadian dollars

European Union seems to have a limit of €2,000

South Africa is R12,000

All these jurisdictions have other conditions for a claim to qualify as a 'Small Claim', so it is best to research within your local boundary or ask a lawyer / solicitor.

NB I do not suppose to be qualified to advise on a 'Small Claim' under every legal juristiction in the world (that's the job of local lawyers). To access a more detailed approach to starting a 'Small Claim' in your particular country or state, click on the place you want, from the sample list below (or do what I did and Google 'Small Claims Court <then insert your state or country>', as a first step:

New Zealand (typical pathway in New Zealand is via their Companies Act and issuing a Statutory Demand, then maybe applying to put the debtor into liquidation. A last resort of course.)

Massachusetts ; Utah ; California ; Colorado ;Missouri ; Pennsylvania

European Union (except Denmark); Finland

Debt Recovery made simple.

Well, how was that?

Useful?

To learn more about Debt Recovery and a whole lot more business hints and tips, just fill in the boxes below and you'll be receiving the exclusive Missing Piece Marketing reports from me (if you don't already receive them):

Get instant access here:

NB. Did I mention the reports are all FREE? (and you can unsubscribe at any time - with my best wishes)

Here's to your Cash Flow!

Paul Johnson